How to File ITR Online in India — AY 2025–26 (Complete Step-by-Step Guide with Visuals)

Want to know how to file ITR online in India for Assessment Year 2025–26? You’re in the right place. This guide will walk you through everything — from documents required to screenshots of the actual portal. Whether you’re a salaried employee, freelancer, pensioner, or small business owner, this tutorial will help you learn how to file ITR online in India with confidence.

Why You Should Learn How to File ITR Online in India

In today’s digital age, relying on someone else to handle your income tax return is not only outdated but unnecessary. Filing your ITR online is:

- Simple — thanks to pre-filled forms and intuitive UI

- Safe — login and file securely via OTP or net banking

- Fast — receive refunds within 7–15 days if filed correctly

- Cost-effective — no need to pay CA or consultants for basic filings

Once you know how to file ITR online in India, you can manage your taxes on your own, year after year. It’s an essential financial skill.

Who Needs to File an ITR in India?

If your income exceeds the basic exemption limit (₹2.5 lakh for those below 60), it is mandatory to file an ITR. However, even if your income is below the limit, you should file ITR for reasons such as:

- Claiming tax refunds

- Applying for loans or visas

- Carrying forward losses

- Maintaining financial records

So knowing how to file ITR online in India benefits almost everyone — not just those with high incomes.

Documents Required Before You File

Before starting the process of how to file ITR online in India, keep these documents ready:

- PAN Card and Aadhaar Card (must be linked)

- Form 16 (from your employer)

- Form 26AS, AIS and TIS reports

- Bank passbooks or interest certificates

- Investment proofs for deductions (ELSS, LIC, PPF, NPS, etc.)

- Medical insurance receipts (for Section 80D)

- Loan repayment certificates (home loan, education loan)

- Rent receipts if claiming HRA

- Capital gain reports (if you sold mutual funds or shares)

- Foreign income/assets details (if applicable)

Having these at your fingertips will make the entire process smoother and faster.

Selecting the Right ITR Form

This is the most important step in understanding how to file ITR online in India. Selecting the wrong form can result in rejection or delay of refunds. Here’s a simplified table:

| ITR Form | Who Should Use It? |

|---|---|

| ITR-1 (Sahaj) | Salaried individuals with income up to ₹50L, one house, no capital gains |

| ITR-2 | Individuals with capital gains, multiple houses, or income above ₹50L |

| ITR-3 | Business or professional income (including stock trading) |

| ITR-4 | Presumptive income under Sections 44AD, 44ADA, or 44AE |

Most salaried taxpayers will use ITR-1 unless they have other complexities like capital gains or rental income from multiple properties.

Step-by-Step Guide on How to File ITR Online in India

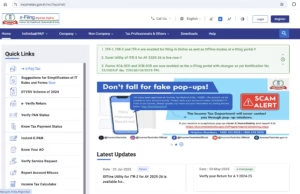

1. Visit the Official Income Tax Website

Go to incometax.gov.in. This is the official government portal for e-filing. Make sure you’re not using a third-party or fake site.

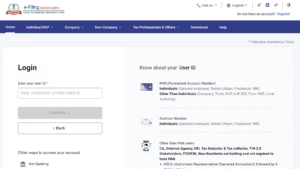

2. Log In to Your Account

Click on the “Login” button on the top-right. Use your PAN number as the User ID. Enter the password and the captcha code. If you’re a new user, click on “Register” and follow the steps to create an account.

3. Navigate to File Income Tax Return

After logging in, go to the top menu and click: e-File → Income Tax Returns → File Income Tax Return

4. Select Assessment Year 2025–26

Choose the assessment year as 2025–26. The portal will ask if you want to file online or offline. Select “Online” and proceed.

5. Choose the Right ITR Form

Now, the portal will auto-suggest a suitable ITR form based on your previous filings. However, you can still choose manually. Most salaried taxpayers should go with ITR-1.

6. Confirm Personal Details

You’ll now see a page showing your details, like:

- Name

- Date of Birth

- Aadhaar Number

- Contact Information

- Bank Account (must be pre-validated)

Verify and proceed.

7. Income Details: Verify Form 26AS, AIS & TIS

This step is crucial when learning how to file ITR online in India. The portal automatically fetches data from your:

- Form 26AS (TDS deducted by the employer or banks)

- AIS (Annual Information Statement)

- TIS (Taxpayer Information Summary)

Review every line item—salary, interest income, dividend, capital gains — and ensure it’s accurate.

8. Enter Your Deductions

Now, declare your deductions under various sections like:

- 80C – LIC, ELSS, PF, tuition fees

- 80D – Health insurance premium

- 80G – Donations to charities

- 80TTA – Interest from savings bank account

9. Compute Tax and Preview

The system now shows a summary of:

- Gross Income

- Total Deductions

- Net Taxable Income

- Tax Liability

- TDS Already Paid

- Refund or Remaining Tax Payable

Review this section carefully. If everything looks good, click “Proceed to Preview.”

10. Pay Remaining Tax (If Applicable)

If you have taxes due, the portal will redirect you to the payment page. You can pay via:

- Net Banking

- Debit Card

- UPI

After payment, you’ll get a Challan Reference Number. Save this for future reference.

11. Final Review and Submission

Once you’ve paid any due taxes (if applicable), go back to the filing page and click “Submit Return”.

You’re almost done!

12. E-Verify Your Return

This is the final step in how to file ITR online in India.

You must e-verify within 30 days of submission. Choose one of the following:

- Aadhaar OTP (fastest)

- Net Banking

- Bank/Demat account verification

- Sending signed ITR-V to CPC Bangalore (if you skip e-verification)

Once you verify, the return is officially complete. You’ll receive an acknowledgment on your registered email and mobile number.

Common Mistakes to Avoid While Filing ITR Online in India

Even if you’ve followed the steps on how to file ITR online in India, there are still some common errors that could delay your refund or lead to notices from the department. Here’s what to avoid:

- Incorrect ITR Form: Always double-check the eligibility for each form. Using ITR-1 when you have capital gains is a common mistake.

- Mismatch in Form 26AS and TDS: Ensure that all entries in your Form 26AS and AIS match with what you declare. Discrepancies can trigger scrutiny.

- Skipping Deductions: Many people forget to claim deductions they’re eligible for — like 80D or 80TTA.

- Wrong bank account details: If the account isn’t pre-validated, your refund will get stuck.

- Failure to e-verify: Your return will be treated as “not filed” if not e-verified within 30 days.

How to Track Refund After You File ITR Online in India

Once your ITR is submitted and verified, your refund — if applicable — will be processed by the CPC and credited to your validated bank account.

Steps to Check Refund Status:

- Go to incometax.gov.in and log in.

- Click on e-File → Income Tax Returns → View Filed Returns.

- Locate the AY 2025–26 and click View Details.

- Your refund status will show as “Processed”, “Refund Issued”, or “Under Processing”.

Refunds typically take 7–15 working days after e-verification. Delays may happen if details don’t match or need clarification.

Frequently Asked Questions (FAQs)

A: Yes. If you are aware of your salary details and tax deductions, you can file using Form 26AS and AIS.

A: Yes. It’s the most popular method. Alternatively, you can use net banking or bank verification.

A: You can file a belated return, but with late fees. Refunds may also be delayed.

A: Yes, you can file a revised return if you discover an error in your original ITR — as long as it’s before the deadline.

A: September 15th, 2025, for salaried individuals (unless extended).

Bonus Tips for Smooth Filing

- File early — avoid portal rush and delays near the deadline.

- Download and review AIS & TIS before starting the process.

- Use a desktop or a laptop instead of a mobile for a full portal experience.

- Take screenshots of each page while filing, for your record.

- Use a pre-validated bank account to avoid refund issues.

Explore More on Wealthlook.com

- Income Tax Calculator for FY 2025–26

- SIP vs Lumpsum Investment in 2025

- Top Mutual Funds to Invest in 2025

Final Thoughts

Learning how to file ITR online in India is no longer a challenge. The new portal is intuitive, documents are mostly pre-filled, and verification takes just minutes. Once you file your return independently, you gain financial confidence — and save money.

By following this step-by-step guide, you’ve covered everything from choosing the correct ITR form to verifying your return and tracking your refund. Remember, the earlier you file, the better it is for your finances.

Ready to file? Head to incometax.gov.in now and take control of your taxes today.

For more helpful tools, guides, and calculators, keep visiting Wealthlook.com — your trusted destination for smart financial living.