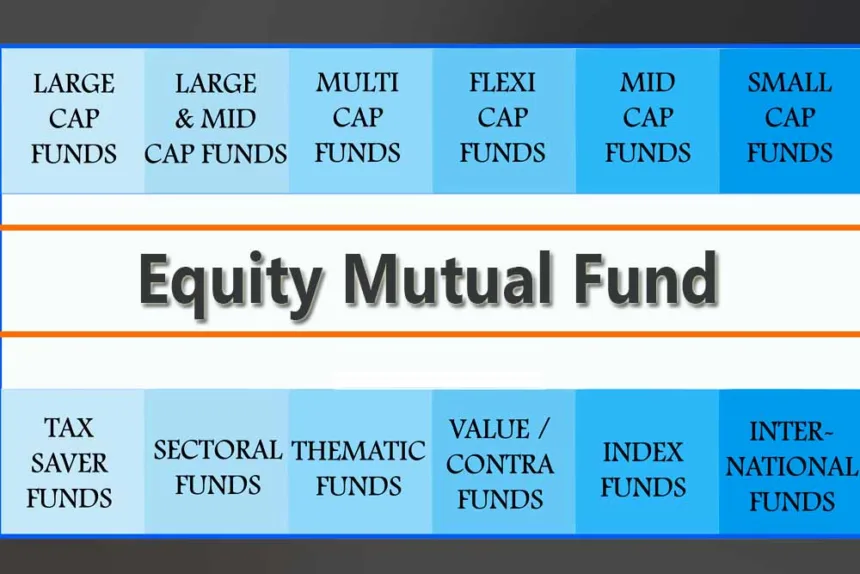

In the last 5 years, Equity MF schemes have become a guiding light. They are the preferred investment option for those investors seeking long-term growth. The Mutual Fund industry is at the peak of its popularity, and there is an enormous variety of funds available to investors.

Thus, singling out programs that surpass their benchmarks is a primary task. Investors may favour equity MF schemes which outperform the market, stimulated by the desire for higher returns. Now we are going to direct our attention to the luminaries of the Indian fund sector, which are the competitors from large, mid and small-cap segments.

Surprisingly, they all beat the averages of their respective benchmarks. Additionally, this analysis exposes the winners who are now in the limelight with their accomplishments and serves as a guide for investors who want to manoeuvre through the intricate terrain of high-yield investments.

Consequently, we are going to go through the strategies that make these funds stand out in a congested marketplace with detail. Check out the details on equity MF schemes

Spotlight On High Achievers: Equity MF Schemes

In the scenery of mutual funds, many funds of different market segments have shown remarkable performance in the last three years. Therefore, Data from the AMFI website is the source of the leaders in every category. The fund, Nippon India Large Cap Fund, is the first in the large-cap category with a direct three-year return of 25.38%.

However, the next fund in the list is HDFC Top 100 Fund with 21.82%. ICICI Prudential Bluechip Fund is the second-largest fund with a size of 21.74%. JM Large Cap Fund and Invesco India Large Cap Fund have also emerged among the top performers with returns of 21.29% and 20.29% respectively.

Quant Mid Cap Fund takes the lead in the mid-cap funds category, showing the highest direct three-year return of 32.99%. Motilal Oswal Midcap Fund and Mahindra Manulife Mid Cap Fund have returns of 27.69% and 26.77% respectively, so they are not far behind.

Furthermore, PGIM India Midcap Opportunities Fund and Edelweiss Mid Cap Fund completed the top five with returns of 26.61% and 26.35%.

Quant Small Cap Fund has recently outperformed all other small-cap funds with a direct three-year return of 37.81%. Bank of India Small Cap Fund and Nippon India Small Cap Fund come next, recording a return of 32.18% and 30.47% respectively. Edelweiss Small Cap Fund and Canara Robeco Small Cap Fund also rank high, with a return of 29.45% and 28.66%.

Unveiling The Best Performers For Equity MF Schemes

Top Five Large-Cap Funds

- Nippon India Large Cap Fund- 25.38%.

- HDFC Top 100 Fund- 21.82%

- ICICI Prudential Bluechip Fund- 21.74%

- JM Large Cap Fund – 21.29%.

- Invesco India Large Cap Fund- 20.29%.

Leading Mid-Cap Contenders

- Quant Mid Cap Fund – 32.99%.

- Motilal Oswal Midcap Fund – 27.69%.

- Mahindra Manulife Mid Cap Fund- 26.77.

- PGIM India Midcap Opportunities Fund-26.61%.

- Edelweiss Mid Cap Fund – 26.35%.

Small-Cap Stars

- Small Cap Fund – 37.81%

- Bank of India Small Cap Fund- 32.18%.

- Nippon India Small Cap Fund- 30.47%

- Edelweiss Small Cap Fund- 29.45%

- Canara Robeco Small Cap Fund- 28.66%

Finally, This equity MF schemes mix showcases various categories by the top 15 mutual funds. It provides a range of investment vehicles for various risk profiles and investment goals. By focusing on performance and using a strategic approach, investors can get the results they want and may even make a lot of money.

Whether you are a conservative investor with a propensity for large-caps or a risk-taker with a penchant for small-caps, it is essential to appreciate these leaders. Therefore, this money is referred to as a tool for investors who are looking to boost their portfolios as they have beaten their benchmark.

You can join our Facebook page to get regular updates and News